Prepaid Cards & Online Banks Testing Competitor Messaging

Project Overview

One of Visa’s external clients in the space of prepaid cards and digital banking is releasing new packaging for one of their most popular products. This client was seeking to better understand the consumers of challenger products, and to evaluate their current product messaging against that of competitors in order to understand what resonates with their target audience.

Impact

After presenting the findings to our client, they walked away with a better understanding of what their customers need, what messaging is appealing to them, and what adjustments they need to make to their current messaging. After going back and making these changes, our client returned with an updated design for us to test with their target audience.

My Role

I was a support researcher responsible for the unmoderated competitor messaging analysis part of this study. This consisted of writing an unmoderated test, recruiting participants, analyzing the data, and presenting our competitor messaging findings to our client.

I am only presenting the work I was responsible for and will be leaving out part 1 of the study.

Methods

17 participants (both digital wallet and prepaid card users)

Participants were shown seven different concept boards displaying the tagline, key features, and pricing of competitor products. They then answered questions about each individual board before completing a final reflection comparing all the products.

Research Objectives

Project Goals

Compare client’s product messaging against that of competitor products

Gather directional feedback on how to best message products to consumers

Research Questions

What features and messaging resonate with consumers?

What causes users to hesitate when looking at product messaging?

Which competitor product’s messaging best resonates with users and why?

Which competitor product messaging is least attractive to users and why?

Methodology

17 Participants took part in unmoderated sessions where they were asked to imagine that they were on the hunt for a new banking solution.

Participants were shown 6 different advertising boards displaying the tagline, key features, and pricing of our clients’s competitor products.

They were then asked questions about each individual board before completing a final reflection comparing all the competitor products.

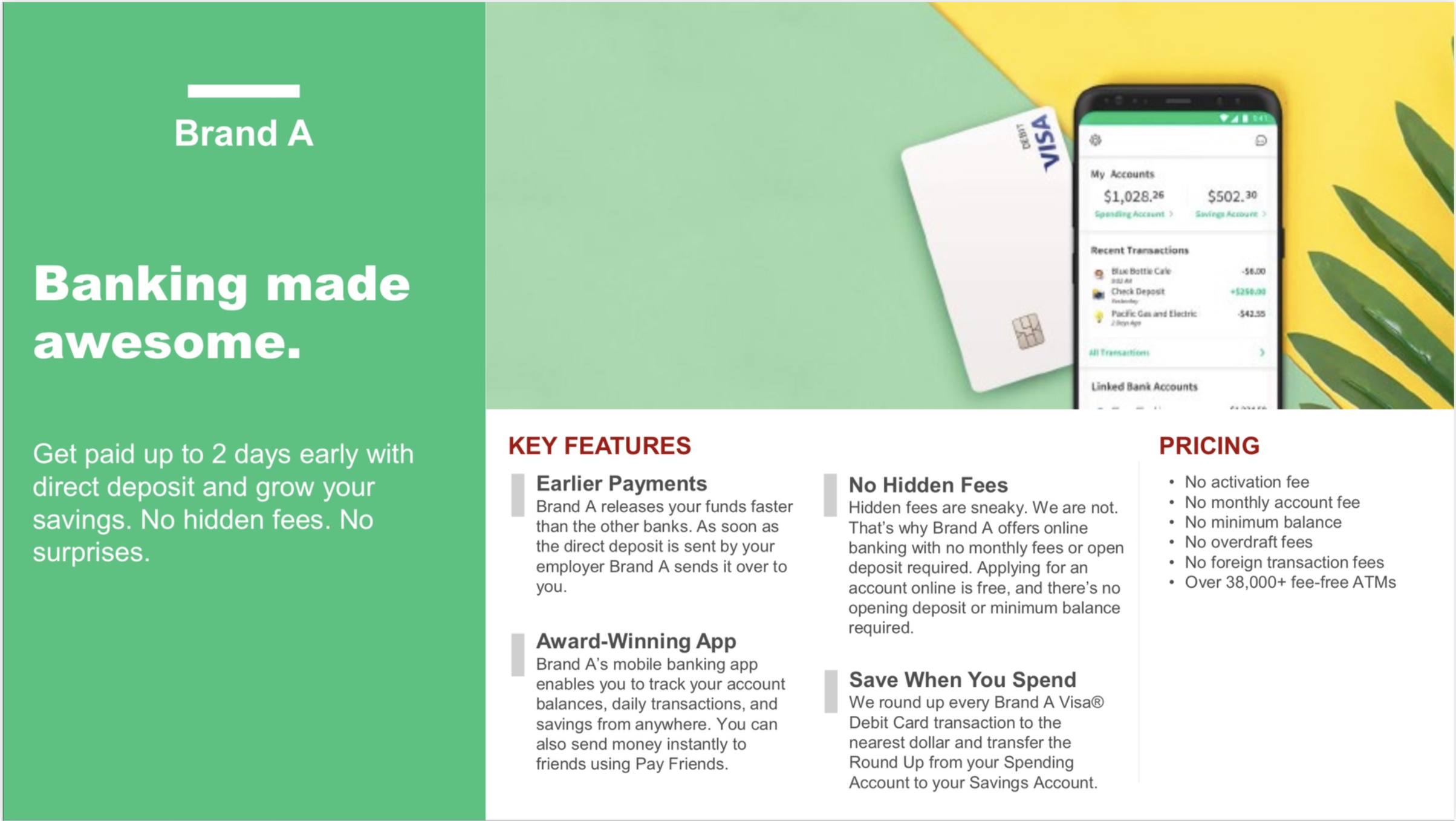

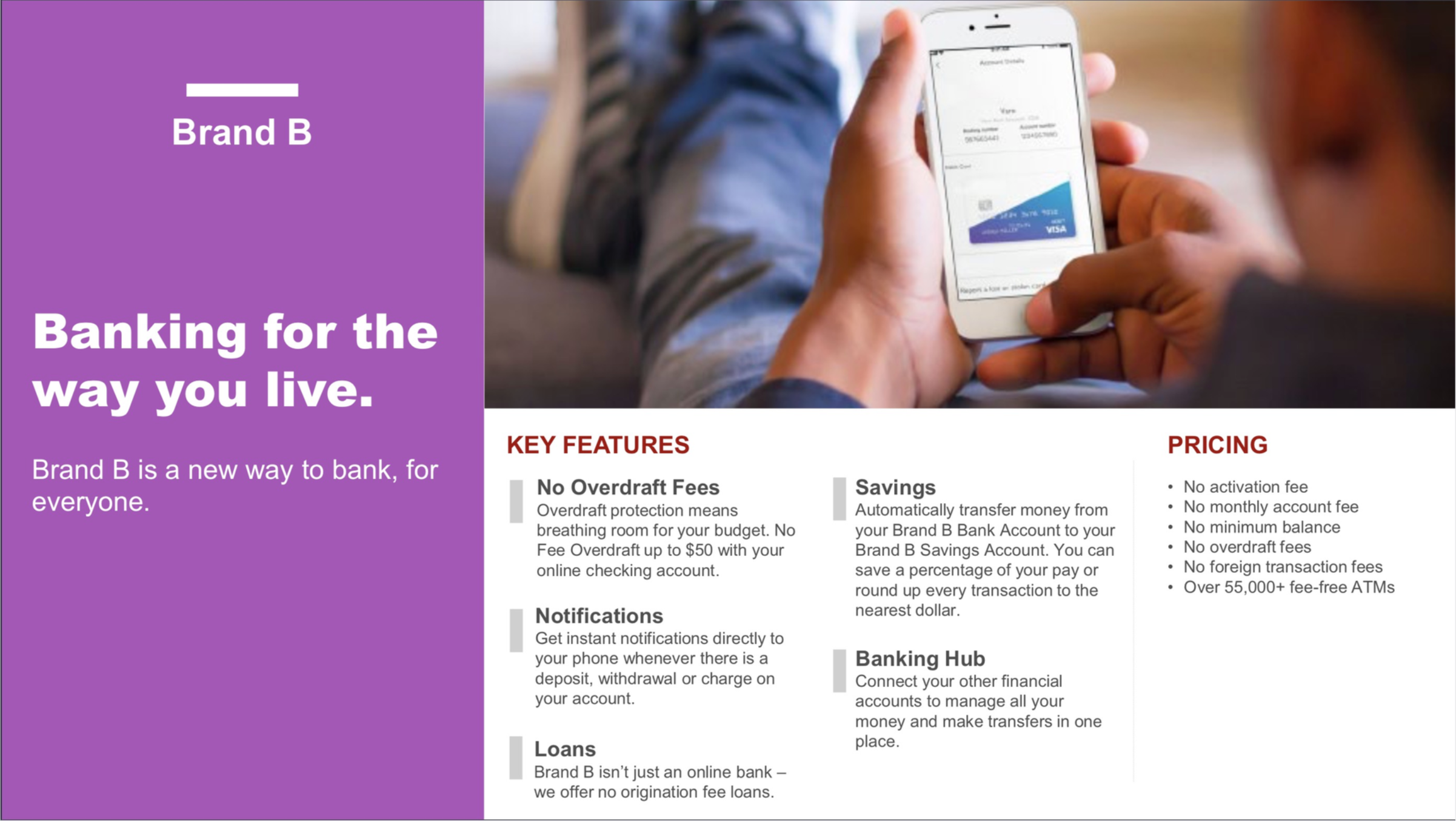

Sample Boards:

Recruiting Participants

Recruitment Criteria

Segment 1: Digital Bank Users

Has a digitally-based banking account with one of the defined challenger banks

Income: $50k-$110k

Segment 2: Prepaid Card Users

Unbanked or Underbanked (does not have a traditional banking account or access to one)

Own a general purpose reloadable (GPR) card and uses it regularly (at least once a month)

Household Income: Less than $50k

Participant Demographics

17 participants

All Walmart shoppers

Mix of genders (50/50)

Mix of African American, Hispanic, and Caucasian participants

Age ranges: 18-54

Recruitment

After writing a screener that captures our target demographic I uploaded it to dscout, a tool that allows researchers to conduct remote live video sessions. I was presented with hundreds of participants from dscout’s participant panel who meet our criteria.

Sample Screener Questions:

How frequently do you use your reloadable or prepaid card? [single select]

Daily [accept]

Every week [accept]

Every month [reject]

Every few months [reject]

Select all the reloadable cards you currently use or have used in the past. [multiple select]

Green Dot

NetSpend

Walmart MoneyCard

Go bank Checking account

Other [tap to type]

One of my favorite screening methods when using dScout is to request a video response in the screener. In this case, I asked participants to tell me more about how they use their reloadable or prepaid card, how they started using it, and why they choose their specific card.

These video responses gives me a good idea of how verbose a candidate is when talking about the subject matter and helps me guarantee they meet the criteria I am looking for.

Unmoderated Tests

Competitor Messaging Boards

Sample Questions:

Scenario: Imagine that you have decided to explore alternative banking options to receive and spend your money. You decide to do some research on the options that are out there in order to see if there are any good solutions for you.

While doing your research, you come across six different options that you want to look into. This is the first alternative banking solution that you see. Please read over this advertising card and think aloud as you go.

What are your first impressions of this solution?

In your own words, describe how this solution would work for you.

Are there any words or phrases that stand out to you? Why do they stand out?

Is there anything that would make you hesitant to choose this option? Why?

How appealing was this option, on a scale of 1 to 5. Why? [5-point Rating Scale: Not appealing at all to Very appealing]

Now that you have looked at six different options, you pull them all up again to understand the main differences.

Please explain the main differences between all the options you explored today.

After researching all six of these alternative payment options, are you interested in choosing one?

If so which one are you interested in signing up for? Why?

What stood out to you about the option that you chose?

Which of the six options are you least likely to sign up for? Why?

Is there any information that you need to know before signing up for this option right now? What is it?

Synthesis

After the unmoderated sessions wrapped up, I jumped into synthesis in Mural, one of my favorite tools. I pulled in all the data from dScout and starting combing through the results to search for themes.

Laying everything out in one board, I was able to extract the key themes and link them to the supporting evidences and quotes from the sessions. I was able to identify what messaging worked well, what words and phrases resonated with participants, and which phrases caused hesitations or doubts.

Sample Insights and Recommendations

Appealing Messaging

Clear, detailed messaging

Participants felt more trusting of messaging that was easy to understand and provided detailed information about features and fees.

“Knowing I have to pay an activation fee makes me trust you more. As opposed to wondering how you'll make money off me.”

This includes clearly stating out the specific prices, APR rates, and any other fees involved in a way that is easy to understand.

“I like that there's additional information given here, like numbers. This one doesn't assume I'm stupid. This seems to offer genuine transparency.”

Empathetic Language

Customers want to feel that their needs are being put first, that the company cares about them and their specific needs.

“It sounds like they're trying to help customers rather than charge them more in fees all the time.”

Consumers appreciate that their desire to use an alternate way of banking is being recognized and that the solution is addressing their unique situations.

“I like their attitude that seems to understand that I lead an alternative lifestyle or at least that they'd be interested in wanting to understand my lifestyle.”

Unappealing Messaging

Conditional Messaging

Conditional messaging causes consumers to feel trapped and distrustful of a solution.

“Starts off with a great tag line that makes me feel good, then the first advertised "feature" is conditional. Come on.”

“I don’t like having to keep up with that amount being deposited just to have my account fee waived.”

False Transparency

Consumers are weary of false transparency when a board seems to be missing key information that there will be “catches” they need to watch out for.

“Companies appear forthcoming and honest by saying "no hidden fees" to distract from somewhere they might bite you. I'd feel more comfortable knowing the "gotchas" upfront.”